New Tax Regime vs Old

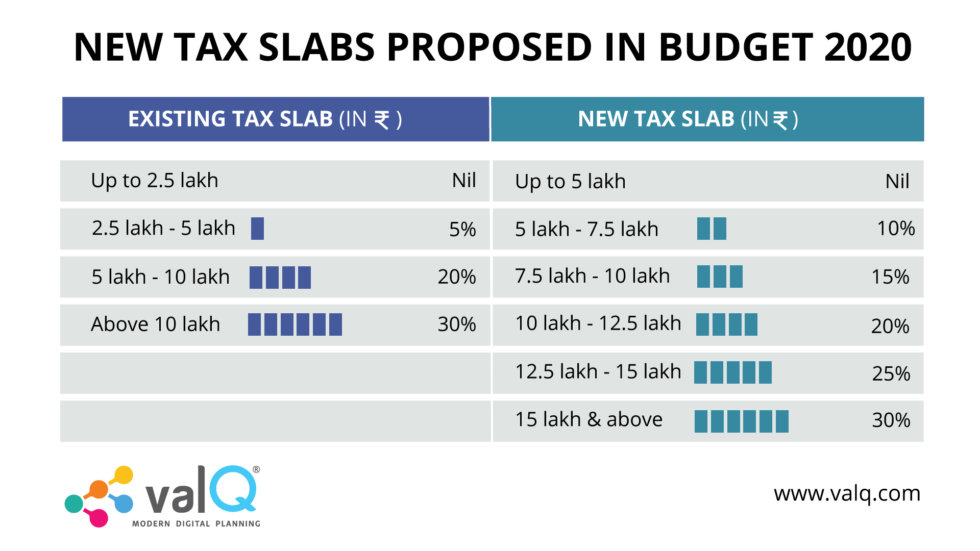

In Union Budget 2020, the Finance Minister introduced several proposals to the personal tax regime. In order to reduce total tax liability by individuals, the Union Budget slashed income tax rates. As proposed in the new regime, 70 tax exemptions will be removed but the tax rates have been cut down.

The budget 2020 has given taxpayers the option to choose between

- Existing tax regime which allows availing existing tax exemptions and deductions

- New one with slashed income tax rates but no tax exemptions and deductions

Now, the question of debate is which one would be beneficial for an individual? It is highly specific to an individual’s income composition and investment. Everyone will have to work on their income calculations to figure out which suits them better.

Choose the right taxation with ValQ

In order to make it easy for all, we at ValQ have come up with a simulation model that would help us choose between the two. Watch the video below to understand how you can configure your income, deductions, and exemptions in ValQ and identify which fits you the best.

You can download the pre-configured tax estimator file below

About ValQ – ValQ is a serverless, lightweight, multi-purpose application running on Power BI supporting use cases such as planning, forecasting, budgeting, time series forecasting and value driver planning

Get started with ValQ today!